Consider two projects. The first project pays benefits of $90 today and nothing else. The second project pays nothing today, nothing one year from now, but $100 two years from now. Which project would be preferred if the discount rate were 0%? What if the rate increased to 10%?

What will be an ideal response?

Consider two projects. The first project pays benefits of $90 today and nothing else. The

second project pays nothing today, nothing one year from now, but $100 two years from now.

Which project would be preferred if the discount rate were 0%? What if the rate increased to

10%?

You might also like to view...

If you own a bond with a 3 percent coupon rate and new bonds are paying 8 percent, what will happen to your bond's market price?

What will be an ideal response?

When did the Federal Reserve Act become law?

A) 1836 B) 1913 C) 1936 D) 1951

Pete consumes two goods, rice and fish. When the price of fish rises, he consumes less fish. When the price of rice rises, he consumes more rice. For Pete,

a. fish is not a Giffen good but rice is. b. rice is not a Giffen good but fish is. c. both fish and rice are normal goods. d. both fish and rice are Giffen goods.

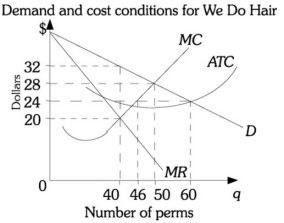

Refer to the information provided in Figure 15.2 below to answer the question(s) that follow.  Figure 15.2 Refer to Figure 15.2. In this monopolistically competitive industry, in the long run

Figure 15.2 Refer to Figure 15.2. In this monopolistically competitive industry, in the long run

A. product supply will decrease so prices will go up. B. firms will suffer economic losses profits. C. firms will enter until all firms break even economically. D. demand for the product will increase so that profits are increased.