A tariff is

a. a tax on imports.

b. a tax on exports.

c. a payment by the government to an exporter.

d. a legal limit on the amount of a good that may be imported.

a

You might also like to view...

Your task is to estimate the ice cream sales for a certain chain in New England

The company makes available to you quarterly ice cream sales (Y) and informs you that the price per gallon has approximately remained constant over the sample period. You gather information on average daily temperatures (X) during these quarters and regress Y on X, adding seasonal binary variables for spring, summer, and fall. These variables are constructed as follows: DSpring takes on a value of 1 during the spring and is zero otherwise, DSummer takes on a value of 1 during the summer, etc. Specify three regression functions where the following conditions hold: the relationship between Y and X is (i) forced to be the same for each quarter; (ii) allowed to have different intercepts each season; (iii) allowed to have varying slopes and intercepts each season. Sketch the difference between (i) and (ii). How would you test which model fits the data the best? What will be an ideal response?

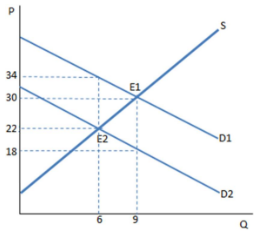

Consider the graph. What would most likely be the cause of a shift from D1 to D2?

A. A tax on sellers

B. A tax on buyers

C. A subsidy for sellers

D. A subsidy for buyers

Suppose the respective prices of yogurt, candy bars, and popcorn in Year 1 are $1, $2, and $3 . In Year 2, the unit prices of each are $2, $3, and $4 respectively. Which of the following statements is true of the price level between Year 1 and Year 2? a. It decreased by 20 percent

b. It increased by 33 percent. c. It increased from $6 to $9. d. It decreased at a rate between 20 percent and 50 percent. e. It increased at a rate between 33 percent and 100 percent.

The more human capital you have, the more likely you will:

A. be unemployable. B. earn more money. C. not benefit from specializing. D. All of these are true.