The average tax rate faced by an individual is the ________

A) total tax paid by her divided by the total income earned

B) total revenue received by the government divided by the number of taxpayers

C) percentage of the last dollar earned that a household pays as a tax

D) difference between the highest tax rate and the lowest tax rate

A

You might also like to view...

One objection to the notion of Ricardian Equivalence is that ________

A) households will recognize that a tax cut today will only lead to a tax increase in the future B) individuals are short-sighted in their spending decisions C) borrowing constraints have largely been eliminated due to financial innovation in the provisioning of consumer credit D) households typically save most of the monies received from a tax cut

In which of the following countries would an increase in per capita income likely result in the most improvement to health status of the population? (2006 per capita incomes in PPP dollars shown in parentheses.)

a. Mexico ($13,383) b. New Zealand ($26,068) c. Germany ($32,900) d. United Kingdom ($34,084) e. United States ($44,639)

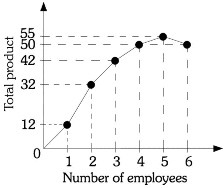

Refer to the information provided in Figure 7.4 below to answer the question(s) that follow.  Figure 7.4Refer to Figure 7.4. The average product with five workers is

Figure 7.4Refer to Figure 7.4. The average product with five workers is

A. 1. B. 2.5. C. 5. D. 11.

The new Keynesians emphasize the importance of

A) rational expectations. B) the monetary growth rule. C) real causes of the business cycle. D) sticky wages and prices.