Under an acreage allotment program,

A) the government sets a limit on the quantity of a product that a farmer is allowed to bring to market, which is intended to cause farmers to cut back on the number of acres they cultivate.

B) farmers are paid to take part of their land out of cultivation.

C) farmers are given limits as to the number of acres that can be farmed.

D) farmers are paid the difference between the market price of their product and a governmentally determined price that would maintain an established price parity.

E) the government establishes a minimum price that farmers will be paid for their product, which causes the farmers to cut back on the number of acres planted.

C

You might also like to view...

Use the neoclassical theory of investment to explain why technological progress that reduces the price of computers (and related information technology) impacts investment differently than technological progress that makes computers more productive

What will be an ideal response?

The U.S. Postal Service expenditures are off-budget

a. True b. False

During a recession, unemployment insurance ensures that:

a. the disposable income of those who are unemployed will increase above the usual level. b. disposable income does not fall by as much as GDP decreases c. disposable income increases as GDP falls. d. the marginal propensity to consume increases. e. the marginal propensity to consume decreases.

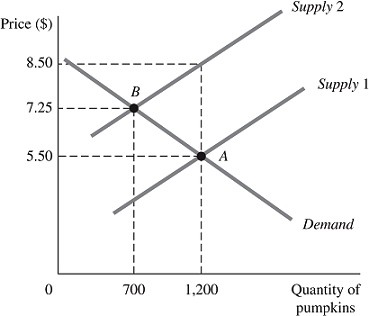

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Using the midpoint formula, the price elasticity of demand for pumpkins from the equilibrium point before the imposition of the tax to the equilibrium point after the imposition of the tax is

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Using the midpoint formula, the price elasticity of demand for pumpkins from the equilibrium point before the imposition of the tax to the equilibrium point after the imposition of the tax is

A. -0.02. B. -0.47. C. -2.11 D. -4.43