If a tax shifts the supply curve upward (or to the left), we can infer that the tax was levied on

a. buyers of the good.

b. sellers of the good.

c. both buyers and sellers of the good.

d. We cannot infer anything because the shift described is not consistent with a tax.

b

You might also like to view...

An increase in the value of a domestic currency in terms of other currencies is known as

A) an appreciation. B) a depreciation. C) a flexible exchange rate. D) a term not given in the above answers.

What is a monopsony?

What will be an ideal response?

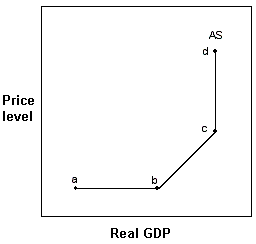

Exhibit 10-1 Aggregate supply curve

A. the segment labeled ab. B. the segment labeled bc. C. the segment labeled cd. D. both segment bc and segment cd.

The last year there was a surplus in the actual U.S. federal budget was in:

A. 2003. B. 2001. C. 2004. D. 2002.