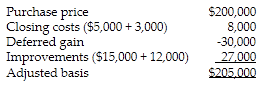

What is the adjusted basis of the home?

In 1997, Paige paid $200,000 to purchase a new residence. She paid a realtor $5,000 to help locate the house and paid legal fees of $3,000 to make certain that the seller had legal title to the property. Under the provisions of tax law in effect at the time of the purchase, she deferred a gain of $30,000 from the sale of a former residence in 1996. In 1999, she added a new porch to the house at a cost of $15,000 and installed central air conditioning at a cost of $12,000. Since purchasing the house, she has paid $2,000 in repairs.

The adjusted basis of the house is $205,000:

Repairs do not affect the basis.

You might also like to view...

The clerk who opens the mail routinely steals remittances. Describe a specific internal control procedure that would prevent or detect this fraud

All of the following statements related to estimated liabilities are true except:

A. Depends on the likelihood that a future event will occur. B. Include vacation benefits or paid absences. C. Can be both current and long term. D. Entry to record includes a debit to an expense account and credit to a payable account. E. Are a known obligation of an uncertain amount that can be reasonably estimated.

A local landscaping company works hard to keep and cultivate profitable current customers instead of constantly investing in gaining new customers that come with unknown return on investment. This company has a ________ orientation.

A. production B. sales C. differentiation D. relationship E. market

Writers should revise for content first and then look at audience appeal and the mechanics of putting together the document

Indicate whether the statement is true or false