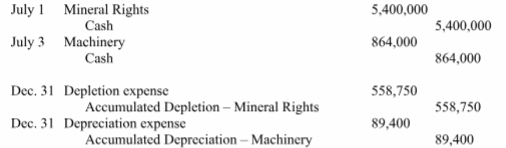

On July 1 of the current year, Glover Mining Co. pays $5,400,000 for land estimated to contain 7,200,000 tons of recoverable ore. It installs machinery on July 3 costing $864,000 that has an 8 year life and no salvage value and is capable of mining the ore deposit in six years. The company removes and sells 745,000 tons of ore during its first six months of operations ending on December 31. Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Prepare the entries Glover must record for (a) the purchase of the ore deposit, (b) the costs and installation of the machinery, (c) the depletion assuming the land has a zero salvage value, and (d) the depreciation on the machinery.

What will be an ideal response?

You might also like to view...

Which sentences uses correct capitalization?

A) The invoice was stamped paid in full. B) The invoice was stamped Paid in full. C) The invoice was stamped Paid in Full.

If I simplify the address 2001:0ed2:056b:00d3:000c:abcd:0bcd:0fe0, I get ________

A) 2001:ed2:56b:d3:c:abcd:bcd:fe0 B) 2001:ed2:56b:d3:c:abcd:bcd:fe C) either A or B D) neither A nor B

Miller River Light is evaluating a project that will require an initial investment of $350,000. Miller River uses a 12% discount rate for capital projects of this type

What level of operating cash flows over a period of 5 years will cause the project to reach break-even NPV? Assume cash flows come in the form of an end-of-the-year annuity. A) $70,000.00 B) $97,093.41 C) $92,329.12 D) $86,690.54

The IRS can assess criminal penalties if fraud is found on a tax return. Name and describe at least two of those criminal penalties.

What will be an ideal response?