The housing bubble experienced in 2006 in the U.S. was exhibited by the extraordinary rise in the ratio of prices of houses to rents on houses

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Does voluntary exchange create wealth (value)?

What will be an ideal response?

When the expected real rate of interest declines, ceteris paribus, we expect:

a. more investment projects will be undertaken. b. lenders will need to lower their average default rate to maintain their profit margins. c. firms will borrow less and cut back on their investment projects. d. individuals will steer clear of equity markets.

Over a period of time both the price and the quantity sold of a certain product have increased. One possible explanation might be that:

a. Supply decreased over time, while demand remained the same b. Demand increased over time, while supply remained the same c. Supply increased over time, while demand remained the same d. Supply increased over time, while demand declined

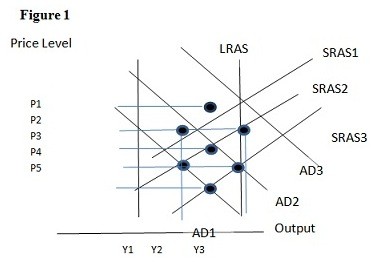

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the long run would be:

A. P2 and Y2. B. P1 and Y2. C. P4 and Y2. D. P1 and Y1.