If gold miners expect the price of gold to be 100% higher one year from now, they will probably

A) decrease the supply of gold they bring to market now.

B) increase the supply of gold they bring to market now.

C) increase the quantity supplied of gold, but supply will remain unchanged.

D) do none of the above.

A

You might also like to view...

If capital gains equal zero, then the Ng family's wealth at the end of the year equals their wealth at the beginning of the year

A) plus consumption minus income. B) plus income. C) plus saving. D) minus personal income taxes. E) minus consumption.

______________ accounts for interrelationships among markets.

Fill in the blank(s) with the appropriate word(s).

________ fixed the exchange rates of Germany, France, Italy, the Netherlands, Belgium, Denmark, Ireland, and Luxembourg beginning in 1979.

A. A currency board B. The International Monetary Fund C. The European Central Bank D. The Exchange Rate Mechanism

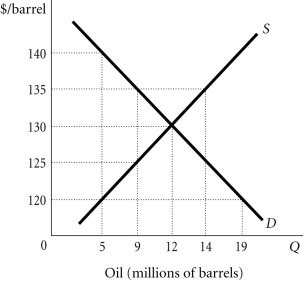

Refer to the information provided in Figure 20.5 below to answer the question(s) that follow. Figure 20.5Refer to Figure 20.5. The domestic price of oil is $130 per barrel, and the world price of oil is $120 per barrel. If the domestic government imposes a tariff of $________ per barrel, it will eliminate all oil imports and achieve tariff revenues of $________.

Figure 20.5Refer to Figure 20.5. The domestic price of oil is $130 per barrel, and the world price of oil is $120 per barrel. If the domestic government imposes a tariff of $________ per barrel, it will eliminate all oil imports and achieve tariff revenues of $________.

A. 5; 45 million B. 5; 20 million C. 10; zero D. 10; 120 million