In the CAPM, unsystematic risk

A. is also known as market risk.

B. can be diversified away.

C. is the risk to a stock's return that is attributable to the fluctuations in the overall stock market.

D. is assumed to be zero.

Answer: B

You might also like to view...

Identify four common mistakes in persuasive communication and discuss how to avoid them

What will be an ideal response?

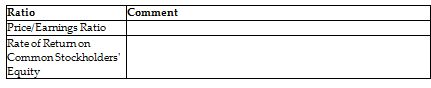

Comment on how an investor would use each of the following ratios to evaluate business performance.

To create an enforceable security interest between Finance Corporation and Global Trade Inc. with a written security agreement, the agreement must contain a description of

A. the debtor. B. the creditor. C. all of the choices. D. the collateral.

Which of the following is a good option for the decision maker when formulating and solving complex nonlinear programming models?

a. Formulating the problem as a linear model and considering the trade-off between a less rigorous formulation and an efficient solution b. Formulating the problem as a nonlinear model and solving it using linear modeling approaches c. Not using an optimization technique and saving on model building and solution costs d. All of the above