A reduction in the marginal tax rate can cause potential output to increase by:

A) encouraging early entry into the labor market by reducing the incentive to earn advanced degrees.

B) increasing after-tax wage rates and thus allowing workers to work fewer hours.

C) increasing the incentive to invest more in education and earn advanced degrees.

D) increasing government revenues and thus government expenditure.

Ans: C) increasing the incentive to invest more in education and earn advanced degrees.

You might also like to view...

Refer to Figure 5-3. With insurance and a third-party payer system, what price do consumers pay for medical services?

A) $40 B) $55 C) $65 D) > $65

The sacrifice ratio measures ______.

a. the amount of output lost when inflation is increased by one percent b. the amount of output lost when inflation is decreased by one percent c. the number of jobs lost when output is decreased by one percent d. the number of jobs lost when output is increased by one percent

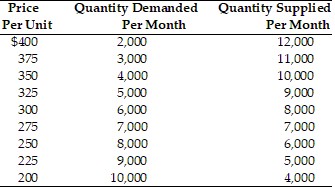

Refer to the above table for smartphones. Suppose there are technological advances in the production of smartphones. The new equilibrium price will be

Refer to the above table for smartphones. Suppose there are technological advances in the production of smartphones. The new equilibrium price will be

A. $275. B. less than $275. C. between $275 and $375. D. $375.

An increase in the interest rate would induce people to

A. get rid of all their money and buy stocks with it. B. hold a smaller fraction of their wealth in the form of money. C. sell their least liquid assets and hold more money in case interest rates go up again. D. sell shares of stock and buy bonds, but would have no effect on their desire to hold money.