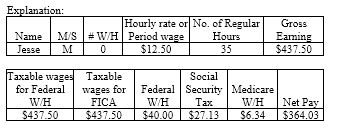

Jesse is a part-time nonexempt employee in Austin, Texas, who earns $12.50 per hour. During the last biweekly pay period he worked 35 hours. He is married with zero withholding allowances, which means his federal income tax deduction is $10.00, and has additional federal tax withholding of $30 per pay period. What is his net pay? (Do not round interim calculations, only round final answer to two

decimal points.)

A) $354.28

B) $374.03

C) $364.03

D) $378.03

C) $364.03

You might also like to view...

When a company sells bonds between interest dates, the company normally will collect from the investors both the selling price and the interest accrued on the bonds from the interest payment date prior to the date of sale

Indicate whether the statement is true or false

Price & Malone Corp., a company based in Houston, caters to a market of individuals and households that buy goods and services for personal consumption. Price & Malone caters to a ________ market

A) business B) reseller C) government D) consumer E) wholesale

Which of the following is an environmental factor that does NOT stimulate creativity?

a. Freedom b. Encouragement c. Competition d. Challenge

Luke typically spends 50-55 hours per week working in the real estate partnership he co-owns with Spencer. Spencer only spends about 30 hours a week on partnership business. Under the RUPA:

a. Luke would be entitled to payment from the partnership for the extra 20-25 hours per week he spends on partnership business unless a partnership agreement denies this right. b. the partners cannot agree to deny extra payment for extra work by a partner. c. unless the partners have otherwise agreed, Luke is not entitled to payment for his work for the partnership, even if it is disproportionate to his partner's work. d. Luke would be entitled to payment from the partnership only if the amount of time and effort he expends on partnership business is grossly disproportionate to that spent by his partner.