According to the above table, if per capita real GDP is currently $1000, then at a constant annual rate of growth of 8 percent, per capita real GDP ten years from now will be equal to

A) $2140. B) $2160. C) $2000. D) $2590.

B

You might also like to view...

Refer to Figure 10-9. If the consumer has $240 to spend on DVDs and CDs, what is the price of a CD if the budget constraint is BC2?

A) $8 B) $10 C) $20 D) $40

Suppose that a firm spends $200,000 to build a factory in 2012 that is expected to have a life of 10 years. As a result, GDP in 2012 will increase by:

a. $20,000 b. $200,000 c. You need to know the selling price of the factory to answer this question. d. It depends upon the tax law regarding depreciation.

The "rate of return" refers to:

a. the increase in future output made possible by investing one unit of current output in capital accumulation. b. the dividend payments made on corporate issued stock. c. the increase in current output made possible by investing in units of future output in capital accumulation. d. the rate at which capital depreciates.

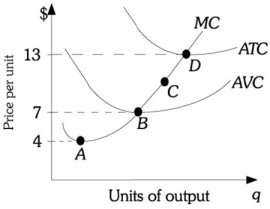

Refer to the information provided in Figure 9.3 below to answer the question(s) that follow.  Figure 9.3Refer to Figure 9.3. This firm will continue to operate in the short run, but incur an economic loss if price is

Figure 9.3Refer to Figure 9.3. This firm will continue to operate in the short run, but incur an economic loss if price is

A. between $0 and $4. B. between $4 and $7. C. between $7 and $13. D. above $13.