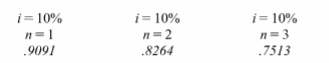

A given project requires a $28,500 investment and is expected to generate end-of-period annual cash inflows of $12,000 for each of three years. Assuming a discount rate of 10%, what is the net present value of this investment? Selected present value factors for a single sum are shown in the table below:

A) $0.00

B) $2,668.00

C) ($7,461.00)

D) $1,341.60

E) $29,841.60

D) $1,341.60

Explanation: (12,000)(.9091 + .8264 + .7513) - 28,500 = $1,341.60

You might also like to view...

Consider the statements that follow.1. Variable selling costs are expensed when incurred.2. The income statement discloses a company's contribution margin.3. Fixed manufacturing overhead is attached to each unit produced.4. Direct labor becomes part of a unit's cost.5. Sales revenue minus cost of goods sold equals contribution margin.6. This method must be used for external financial reporting.7. Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.8. This method is sometimes called full costing.9. This method requires the calculation of a fixed manufacturing cost per unit.Required: Determine which of the nine statements: A. Relate only to absorption costing.B. Relate only to variable costing.C. Relate to both absorption costing and

variable costing.D. Relate to neither absorption costing nor variable costing. What will be an ideal response?

__________is a theory proposing that employees are motivated when they believe they can accomplish a task and that the rewards for doing so are worth the effort.

A. Wage compression B. Pay structure C. Expectancy theory D. Broadbanding E. Equity theory

Gambling entails pure risk

Indicate whether the statement is true or false.

The Federal Trade Commission (FTC) orders GR8 Steaks Company to reveal certain information. GR8 Steaks complains to a court, arguing that the order is an abuse of the FTC's discretion. Like other agencies, the FTC can use a subpoena to

A. compel a party to testify, but not to obtain documents. B. obtain any information except what a party refuses to reveal. C. pressure a party to settle an unrelated matter. D. reveal violations of the law.