Why does a tax change affect aggregate demand?

A. A tax change alters saving by an equal amount.

B. A tax change alters imports and net exports.

C. A tax change alters government spending by an equal amount.

D. A tax change alters disposable income and consumption spending.

Answer: D

You might also like to view...

Many believe that fairness calls for higher income taxes on the wealthy. Using one of the “Ideas for Beyond the Final Exam,” explain how higher taxes on the wealthy will affect output.

What will be an ideal response?

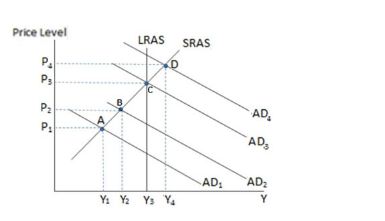

Assuming the economy in the graph shown is currently at equilibrium A, we can conclude:

A. the economy is in a recession.

B. the economy is producing less than its potential level of output.

C. there must be unemployment of resources.

D. All of these are true.

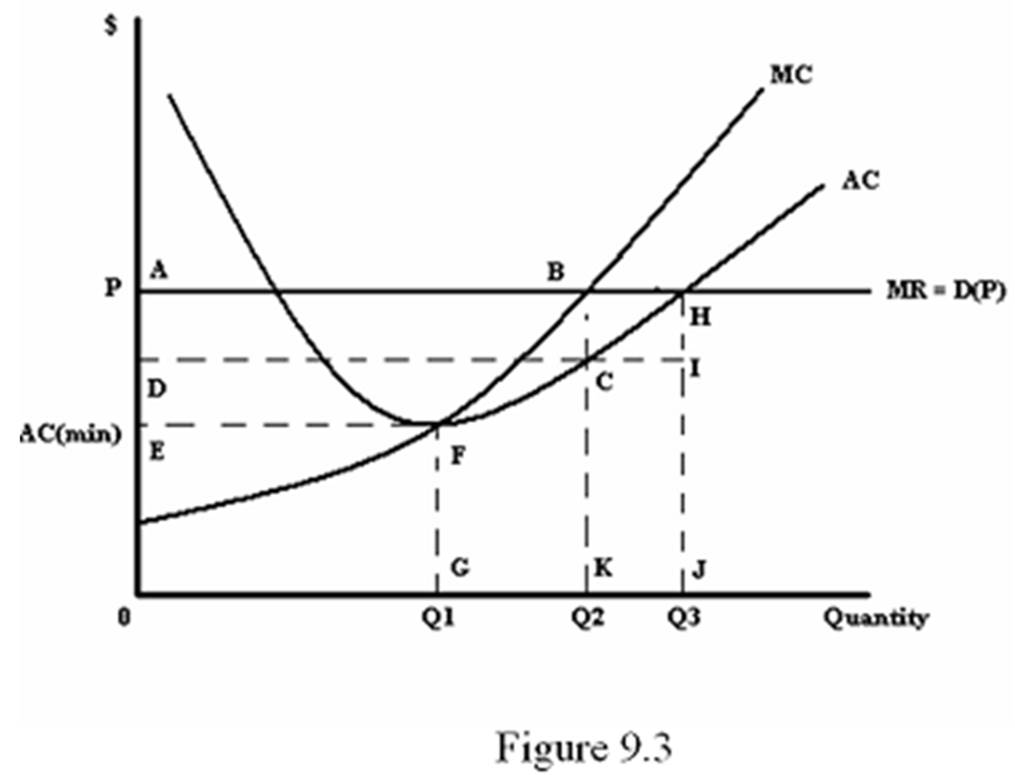

Refer to Figure 9.3. The firm's profit it represented by what area?

A. AHID

B. ABCD

C. DCK0

D. EFG0

Your friend is thinking of opening a video store. She estimates it would cost $500,000 a year to rent the store and buy video stock. She is planning to quit her $50,000 a year job as an accountant to run the store. Her opportunity cost of opening the store is

a. $500,000 b. $550,000 c. $50,000 d. $450,000 e. $60,000