Which of the following statements best describes “bracket creep” within the U.S. income tax code?

a. Until the late 1970s, if real wages increased along with inflation, people were moved into higher tax brackets and owed a higher proportion of their income in taxes, even though their nominal income had not risen.

b. After the late 1970s, if real wages increased along with inflation, people were moved into higher tax brackets and owed a higher proportion of their income in taxes, even though their nominal income had not risen.

c. Until the late 1970s, if nominal wages increased along with inflation, people were moved into higher tax brackets and owed a higher proportion of their income in taxes, even though their real income had not risen.

d. After the late 1970s, if nominal wages increased along with inflation, people were moved into higher tax brackets and owed a higher proportion of their income in taxes, even though their real income had not risen.

c. Until the late 1970s, if nominal wages increased along with inflation, people were moved into higher tax brackets and owed a higher proportion of their income in taxes, even though their real income had not risen.

You might also like to view...

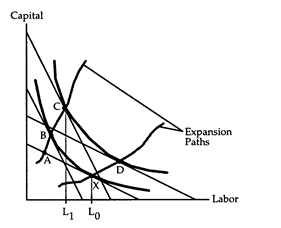

Refer to Reducing Long-Run Labor Usage. The substitution effect of the wage change is the movement from point X to

The following questions refer to the accompanying diagram, which shows a firm reducing its long-run labor usage from L0 to L1 in response to an increase in the wage rate.

a. point A.

b. point B.

c. point C.

d. point D.

If the Environmental Protection Agency (EPA) directs an old lace factory to install an expensive water purification system to treat its wastes before they are discharged into the river,

a. the price of lace will fall b. the lace factory may go out of business c. this directive is unenforceable d. the private cost curve will shift to the right e. more lace is sold so the factory can cover the higher costs

Which of the following is an example of investment spending?

a. The Miller Company buys a used van to make deliveries. b. The Rodriguez family buys stock in the Bonanza Corporation. c. Claude invests his holiday bonus in rare comic books. d. The Gregor Bakery Company spends its profits on new ovens.

An individual's demand curve slopes down because

A. the value of the marginal utility falls as the price falls. B. marginal utility falls as price falls. C. of the law of diminishing marginal utility and the rule of equal marginal utilities per dollar. D. of the rule that the marginal utility of the last unit must equal the price.