Show graphically and explain the effects of imposition of a quota by a small country under competitive conditions. The quota rights are given away for free to a fixed set of import distributor firms in the country.

What will be an ideal response?

POSSIBLE RESPONSE:

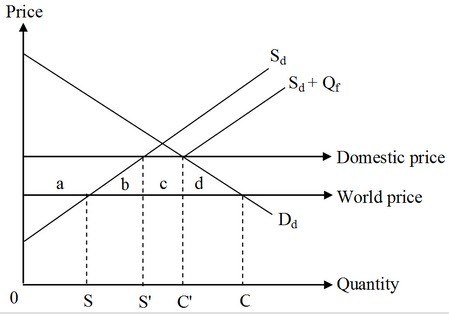

According to the figure, the domestic price was equal to the world price and the quantity imported by this country was represented by the distance SC in the absence of any trade barriers. However, after the government restricts imports by imposing a quota of amount Qf,', the domestic price of the good increases, as shown by the domestic price line. Consequently, domestic production increase to 0S' and domestic consumption declines to 0C'. The loss in consumer surplus due to an increase in the price of the product is given by the sum of the areas a, b, c, and d. The producer surplus increases by the area a. If the government allocates the licenses based on fixed favoritism, area c is obtained by the license holders, who can now sell the imported good at a higher price. The economic cost of a quota arises from the production and the consumption effects resulting from the change in the domestic price of the product. The consumption effect, area d, is the deadweight loss associated with the lower consumption of the good due to the increased price in the domestic market. The production effect, area b, is the deadweight loss arising from the replacement of some low-cost imports with high-cost production in the domestic economy. Thus, a quota imposed by a small importing country will result in a net welfare loss for the country given by the sum of the triangles b and d.

You might also like to view...

A consequence of increasing marginal costs of producing digital music players in Japan is

A) Japan will stop short of complete specialization in the production of digital music players. B) Japan will likely impose trade restrictions on imported digital music players. C) Japan will not export digital music players. D) Japan will import digital music players from countries that don't experience increasing marginal costs.

Suppose the demand in a certain duopoly market with homogenous goods is Qd = 8,000 - 100P. The two firms in the market are firm V and firm W, and the marginal cost of producing the goods in question is equal to $25. Which of the following describes the Nash equilibrium in this market?

A. PV = PW = $25 B. One of the firms charges a price higher than $25, and one of the firms charges a price lower than $25. C. PV = PW > $25 D. PV = PW < $25

Which of the following will decrease the break-even quantity?

a. Falling fixed costs b. Increasing marginal costs c. An increase in the price d. Both A&C

The demand for labor curve bends backward whenever the income and substitution effects work in opposite directions

a. True b. False