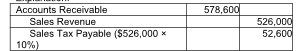

Sales revenue for a sporting goods store amounted to $526,000 for the current period. All sales are on account and are subject to a sales tax of 10%. Which of the following would be included in the journal entry to record the sales transaction?

A) a debit to Sales Revenue for $526,000

B) a credit to Accounts Receivable for $526,000

C) a debit to Sales Tax Payable for $52,600

D) a debit to Accounts Receivable for $578,600

D) a debit to Accounts Receivable for $578,600

You might also like to view...

Accounting records that provide the audit trail for payroll include all of the following except

a. time cards b. job tickets c. payroll register d. accounts payable register

"Authorization was received from the IRS" is an example of a sentence using active voice

Indicate whether the statement is true or false

Writers often include additional information in the introduction to a formal report. Which of the following would not be appropriate to include in the introduction?

A) Describing your secondary sources and explaining how you collected primary data B) Summarizing what other authors and researchers have published on the report topic C) Providing a detailed analysis of the problem D) Defining key terms

Esmeralda is a debtor in a Chapter 7 bankruptcy proceeding. Which of the following is not a duty of Esmeralda under Chapter 7?

a. To undergo credit counseling with an approved agency before filing. b. To provide a repayment schedule for the debt owed to each creditor listed on the creditor list. c. To provide a list of all her assets and debts. d. To provide a schedule of all her income and expenditures.