Company A is rated AAA. Company B is rated BBB. Which of the following are most likely not true?

a. Company A has a larger market capitalization then Company B

b. Company A has greater access to the Commercial Paper Market

c. Company A has a smaller FFO/Debt ratio

d. Company A has a smaller Debt/EBITDA ratio

Answer: c. Company A has a smaller FFO/Debt ratio

You might also like to view...

Analysts reporting on companies will pay close attention to the disclosures regarding pension benefits. Key points include all of the following except:

A. because of high assumed discount rates, most pension plans have remained underfunded with funding ratios ranging between 69% and 86% since 2008. B. to help analysts determine whether fund assets are large enough to satisfy currently anticipated pension benefit payouts, FASB ASC Topic 715 requires firms to provide a table that lists the dollar benefits expected to be paid in each of the ensuing five years and in the aggregate for the five years thereafter. C. while companies with overfunded plans can suspend funding for long periods and use the cash for other operating purposes, underfunded plans may reflect past and continuing cash flow difficulties. D. the common rule of thumb is that a 1% decrease in discount rate would increase PBO by 17.0% whereas a 1% increase would decrease it by 14.5%.

Which of the following is not an approach used for online analytical processing (OLAP).

A. Consolidation B. Data mining C. Exception reports D. What-if simulations

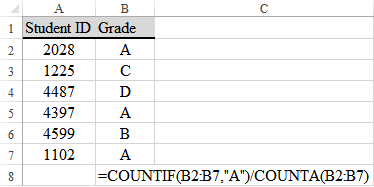

What would be the outcome of cell B8?

a) 3

b) 6

c) 33.33%

d) 50.00%

e) 66.67%

Which of the following is a bad listening habit??

A) ?Making spontaneous judgments about others based on mannerisms B) ?Observing the speaker and interpreting his or her nonverbal cues C) ?Putting in much emotional and physical effort D) ?Putting oneself in another person's shoes