An efficient tax system is one that imposes small

a. deadweight losses and administrative burdens.

b. marginal rates and deadweight losses.

c. administrative burdens and transfers of money.

d. marginal rates and transfers of money.

a

You might also like to view...

The above figure shows the marginal social benefit and marginal social cost curves of doughnuts in the nation of Kaffenia. What is the marginal social cost to the economy of Kaffenia of producing the 300th dozen doughnuts each day?

A) $10.00 per dozen B) $8.00 per dozen C) $6.00 per dozen D) $4.00 per dozen

In a market for emission permits, firms that emit below their allowed limits

A) will buy even more allowances through a trading system. B) are taxed by the government for the amount of emissions. C) receive a subsidy for the amount of emissions. D) will sell their excess allowances through a trading system.

The burden of the public debt

a. cannot create inflation b. may create inflation if it is held by the Fed and financed by taxes c. may create inflation if it is held by foreigners d. may create inflation if it is held by the Fed and financed by the creation of deposits in the Treasury's account at the Fed e. may create inflation if it is held by state and local governments and financed by property or sales taxes

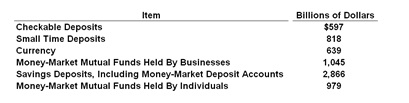

Refer to the table. The size of the M1 money supply is:

A. $979 billion

B. $1,236 billion

C. $1,415 billion

D. $1,618 billion