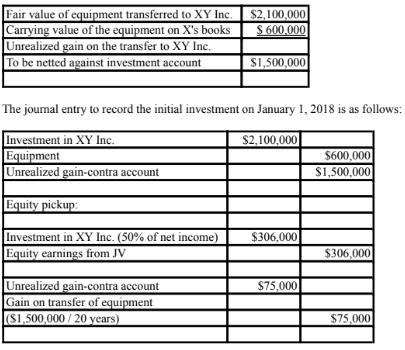

Calculate the gain on the contribution of equipment and prepare the journal entries to record the events on January 1 and December 31, 2018. Also calculate under the equity method X Ltd.'s share of net income and the amount it will recognize.

X Ltd. and Y Ltd. formed a joint venture on joint venture called XY Inc. on

January 1, 2018. X Ltd. Invested contributed equipment with a book value of

$600,000 and a fair value of $2,100,000 for a 50% interest in the joint venture.

On December 31, 2018, XY Inc. reported a net income of $612,000. The

equipment transferred has an estimated useful life of 20 years. Ignore taxes.

What will be an ideal response?

You might also like to view...

The residual income valuation model is a rigorous and straightforward valuation approach, but the analyst should be aware of all of the following implementation issues that will hinder its ability to measure firm value correctly except:

a. common stock transactions. b. portions of net income attributable to equity claimants other than common shareholders. c. dirty surplus accounting items. d. positive book value of equity.

Examples of assignable causes include ______.

a. defective raw materials and components b. defects caused by government regulation c. defects caused by ISO requirements d. defects caused in the natural course of manufacturing

The customer whom Carlotta is calling on today has a(n) ________ buying center culture. This means that the decision process will involve reaching agreement among all members of the buying center.

A. consultative B. republican C. consensus D. democratic E. autocratic

Suppose the real risk-free rate is 3.00%, the average expected future inflation rate is 4.00%, and a maturity risk premium of 0.10% per year to maturity applies, i.e., MRP = 0.10%(t), where t is the years to maturity. What rate of return would you expect on a 1-year Treasury security, assuming the pure expectations theory is NOT valid? Include the cross-product term, i.e., if averaging is required, use the geometric average. (Round your final answer to 2 decimal places.)

A. 8.88% B. 7.15% C. 7.22% D. 7.80% E. 8.95%