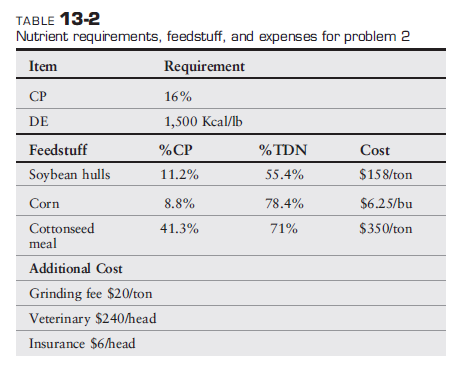

Mr. Brown bought 75 steers averaging 505 pounds for $136 per cwt. He sold the steers averaging 685 pounds for $141 per cwt. He estimated an average daily gain (ADG) of 2.1 pounds per day. Feed conversion is 9:1. (Note: 9 lb of feed consumed result in 1 lb gain.) He borrowed the money for the expenses at 5.25 percent annual percentage rate (APR). The nutrient requirements, feedstuff, and expenses are given in Table 13-2.

a. What was the total cost of the steers?

b. What was the return on the investment?

c. What was the APR of return on the investment?

a. $69,912.82

b. $75,438.75

c. 28%

You might also like to view...

For a cantilever beam loaded in bending, prove that for the guidelines in Figure 2–24.

What will be an ideal response?

A. 1595/2048 in B. 1695/2048 in C. 1795/2048 in D. 1895/2048 in

How many milliamps of current pass through a component rated at 25.0 watts, assuming it has 100.0 ? resistance?

What will be an ideal response?

Net zero energy is a condition whereby the energy used by a building ________________.