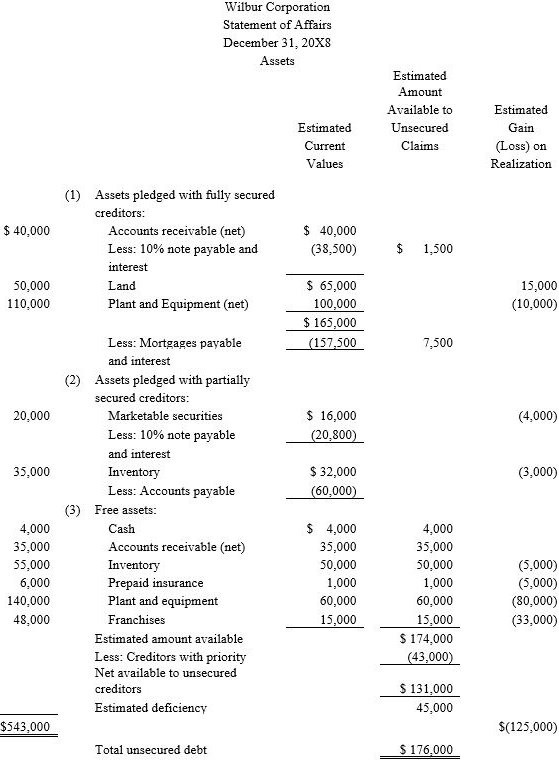

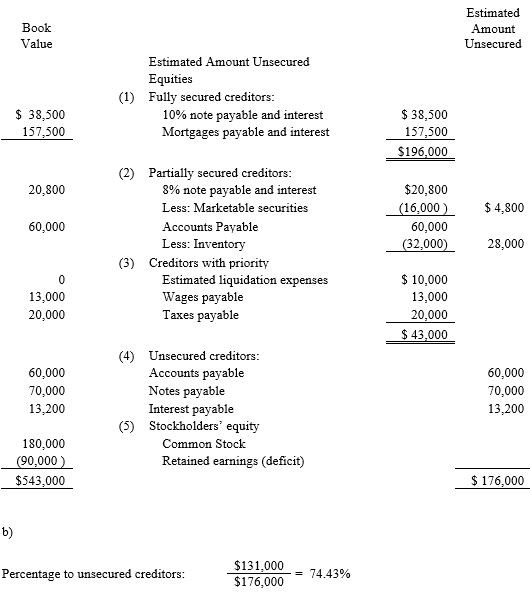

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code. The balance sheet on December 31, 20X8, is as follows: AssetsCash$4,000 Marketable Securities 20,000 Accounts Receivable (net) 75,000 Inventory 90,000 Prepaid Insurance 6,000 Land 50,000 Plant and Equipment (net) 250,000 Franchises 48,000 Total$543,000 EquitiesAccounts Payable$120,000 Wages Payable 13,000 Taxes Payable 20,000 Interest Payable 25,000 Notes Payable 125,000 Mortgages Payable 150,000 Common Stock ($5 par) 180,000 Retained Earnings (deficit) (90,000) Total$543,000 The following additional information is available: 1. Marketable securities consist of 2,000 shares of Bristol Inc. common stock. The market value per share of the stock

is $8. The stock was pledged against a $20,000, 8 percent note payable that has accrued interest of $800. 2. Accounts receivable of $40,000 are collateral for a $35,000, 10 percent note payable that has accrued interest of $3,500. 3. Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000. The appraised value of the remainder of the inventory is $50,000. 4. Only $1,000 will be recovered from prepaid insurance. 5. Land is appraised at $65,000 and plant and equipment at $160,000. 6. It is estimated that the franchises can be sold for $15,000. 7. All the wages payable qualify for priority. 8. The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000. The accrued interest on the mortgages is $7,500. 9. Estimated legal and accounting fees for the liquidation are $10,000. Required:a. Prepare a statement of affairs as of December 31, 20X8.b. Compute the estimated percentage settlement to unsecured creditors.

What will be an ideal response?

You might also like to view...

The most common method of direct-marketing is:

A) direct mail B) telemarketing C) direct response mass media D) e-mails

For available-for-sale equity securities, the Unrealized Loss on Long-Term Investments account should be reported as a(n)

A) realized loss item on the income statement. B) prior period adjustment. C) contra-asset on the balance sheet. D) other comprehensive income (loss).

The issues that take up most of the intercultural negotiation time include all of the following except

a. social-cultural issues. b. political issues. c. religious issues. d. legal issues.

What is the definition of the business judgment rule? Discuss its purposes