In the long-run framework, budget surpluses:

A. should be run whenever output dips below potential output.

B. are better than budget deficits over the long run because unlike budget deficits, they increase saving and investment.

C. should never be run since they crowd out investment in the short run.

D. should be run on a permanent basis since they boost saving and investment and stimulate economic growth.

Answer: B

You might also like to view...

Using the data in the above table, if potential GDP for this economy is $25 billion, then in order to restore full employment, the federal funds rate can be

A) lowered so that government expenditure on goods and services increase. B) raised so that consumption expenditure, investment, and net exports increase. C) lowered so that consumption expenditure, investment, and net exports increase. D) raised so that net exports increase. E) lowered so that consumption expenditure and investment increase, though net exports decrease.

Increases in the burdens of government regulations can make production more costly for producers, shifting the short run aggregate supply curve left; it can also reduce potential output, shifting the long-run aggregate supply curve left

a. True b. False Indicate whether the statement is true or false

Which of the following statements is false?

A) In recent years, the Chinese government has bought U.S. government bonds, raising interest rates in the United States. B) Among the key features of globalization is the growing integration of the national economies of the world. C) Globalization is associated with a movement toward more free enterprise. D) It is becoming increasingly common for Americans to work for foreign companies that have offices in the United States.

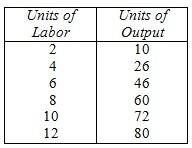

The capital stock is fixed at 5 units, the price of capital is $60 per unit, and the price of labor is $20 per unit.  Based on the above, if the firm produces 80 units of output, what is its total cost of production?

Based on the above, if the firm produces 80 units of output, what is its total cost of production?

A. $5,040 B. $1,900 C. $540 D. $1,600 E. none of the above