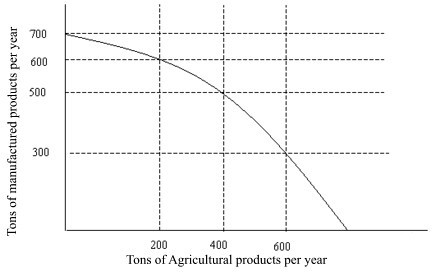

Figure 2.1Refer to Figure 2.1. What is the opportunity cost of increasing production of manufactured products from 500 tons to 600 tons per year?

Figure 2.1Refer to Figure 2.1. What is the opportunity cost of increasing production of manufactured products from 500 tons to 600 tons per year?

A. 200 tons of agricultural products per year

B. 400 tons of agricultural products per year

C. 500 tons of agricultural products per year

D. 600 tons of agricultural products per year

Answer: A

You might also like to view...

The intrinsic value of an option

A) is equal to the option premium. B) is the amount the option actually is worth if it is immediately exercised. C) is the amount the option is expected to be worth on its expiration date. D) is impossible to determine in the absence of information on the future prices of the underlying asset.

An example of a market where a Bertrand model would be plausible is the market for

A) oil. B) wheat. C) beer. D) sugar.

According to Ricardo's explanation of land rent, what happens when the demand for land increases?

A) The supply curve shifts to the right just enough to keep the price per acre constant. B) Revenues to owners of land increase but economic rent declines. C) The amount of economic rent stays constant, constrained by a perfectly inelastic supply curve. D) Both revenues to owners of land and economic rent increase.

Nick has a certain amount of money that he wants to invest in a completely risk-free manner. He would most likely: a. deposit it in a bank or credit union

b. invest in a mutual fund. c. purchase shares on the stock market. d. hide the money somewhere in his or her home.