Assume a simplified banking system subject to a 20 percent required reserve ratio. If there is an initial increase in excess reserves of $100,000, the money supply:

A. increases $100,000.

B. increases $500,000.

C. increases $600,000.

D. decreases $500,000.

Answer: B

You might also like to view...

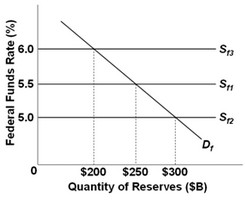

Use the following graph for the federal funds market to answer the next question. If the Fed wants to raise the federal funds rate by one-half of a percentage point, it should ________.

If the Fed wants to raise the federal funds rate by one-half of a percentage point, it should ________.

A. act to increase reserves by $50 billion B. buy bonds from banks and the public C. act to reduce reserves by $50 billion D. pursue an expansionary monetary policy

What is a business cycle and what are its phases and turning points?

What will be an ideal response?

If the government enacts contractionary fiscal policy, it:

A. must want to slow economic activity. B. could increase taxes. C. expects aggregate demand to decrease. D. All of these are true.

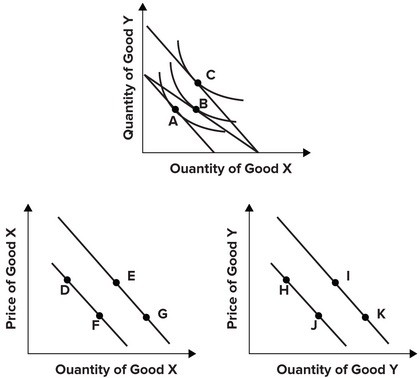

Refer to the graphs shown, which show indifference curve analysis with the associated demand curves. The best explanation for a movement from point D to point F is:

The best explanation for a movement from point D to point F is:

A. an inward rotation of the budget constraint along the x-axis, forcing the consumer to move from point B to point A. B. an outward rotation of the budget constraint along the x-axis, allowing the consumer to move from point A to point B. C. a parallel shift of the budget constraint, allowing the consumer to move from point A to point C. D. an outward rotation of the budget constraint along the y-axis, allowing the consumer to move from point B to point C.