Kathy is 48 years of age and self-employed. During 2019 she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k)?

A. $62,000.

B. $56,000.

C. $83,281.

D. $77,281.

Answer: B

You might also like to view...

A country with a positive current account balance has a trade deficit; that is, the outflow of money to pay for imports exceeds the inflow of money for sales of exports

Indicate whether the statement is true or false

A market-based approach to resolving environmental challenges denies that environmental problems are economic problems that deserve economic solutions.

Answer the following statement true (T) or false (F)

______ is the federal agency that conducts research and makes recommendations to prevent worker injury and illness.

A. Affordable Care Administration B. National Institute of Occupational Safety and Health C. Work–Life Balance Institute D. Social Security Administration

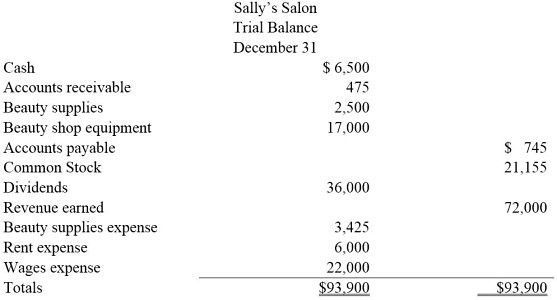

Based on the following trial balance for Sally's Salon, prepare an income statement, statement of retained earnings, and a balance sheet. Sally Crawford, the sole stockholder, made no additional investments in the company during the year.

What will be an ideal response?