If U.S. assets are seen as having greater risk relative to foreign assets in the market for foreign exchange, this should cause the:

A. dollar to appreciate.

B. supply of dollars to decrease.

C. supply of dollars to increase.

D. demand for dollars to increase.

Answer: C

You might also like to view...

In the short run, when the Fed increases the federal funds rate,

A) the real interest rate rises and investment does not change. B) the real interest rate is unaffected but investment still decreases. C) the real interest rate rises and investment decreases. D) there is no effect on investment because investment depends on the real interest rate. E) the real interest rate falls and investment increases.

When the value of nominal GDP increases from one year to the next, we know that one or two things must have happened during that time:

A) The nation produced fewer goods and services and/or prices fell for goods and services. B) Consumption expenditure increased and/or corporate profits increased. C) Investment increased and/or payments to employees increased. D) The nation produced more goods and services and/or prices rose for goods and services. E) the value of real GDP must have increased and/or the price level must have decreased.

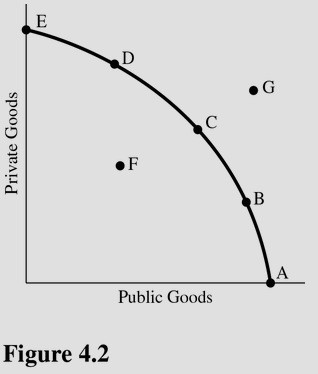

Using Figure 4.2, suppose point C represents the optimal mix of public and private goods for a society. The market mechanism is likely to result in a mix of output represented by point

Using Figure 4.2, suppose point C represents the optimal mix of public and private goods for a society. The market mechanism is likely to result in a mix of output represented by point

A. B because the market mechanism tends to overproduce public goods. B. F because the market mechanism is inefficient. C. D because the market mechanism tends to underproduce public goods. D. C because the market mechanism is efficient.

Which is NOT a characteristic of monopolistic competition?

A) small share of market to each firm B) lack of collusion among firms C) few firms in the industry D) independence of each firm's decisions