Which of the following would be included in the entry by the payee to record a dishonored note receivable?

A) a debit to Accounts Receivable

B) a debit to Interest Revenue

C) a debit to Notes Receivable

D) a credit to Interest Expense

A) a debit to Accounts Receivable

You might also like to view...

In FTC v. Indiana Federation of Dentists, a dentists' organization required its members to withhold x-rays from insurance companies. The Supreme Court held this rule:

a. justified for medical privacy, and so legal b. legal for a profession such as dentistry, which is regulated by the state, to withhold x-rays c. illegal based on a rule of reason analysis d. legal, because the FTC cannot sue medical professionals e. none of the other choices

Cloud computing is a term used to describe how a customer navigates a website

a. True b. False Indicate whether the statement is true or false

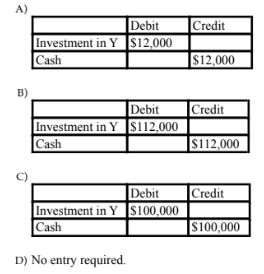

Which of the following journal entries would have to be made to record X's purchase of Y's shares?

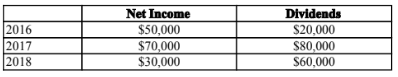

On January 1, 2016, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Historically, the accountant has performed a(n) ______________________________ function to determine the reliability of financial information presented in printed financial statements.

Fill in the blank(s) with the appropriate word(s).