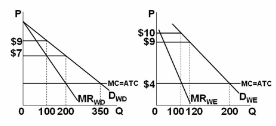

Refer to the figure. Suppose the graphs represent the demand for use of a local golf course for which there is no significant competition (it has a local monopoly); P denotes the price of a round of golf; Q is the quantity of rounds "sold" each day. If the left graph represents the demand during weekdays and the right graph the weekend demand, this profit-maximizing golf course should:

A. charge $9 for each round, regardless of the day of the week.

B. charge $7 for each round, regardless of the day of the week.

C. charge $7 for each round on weekdays and $10 during the weekend.

D. charge $9 for each round on weekdays and $10 during the weekend.

C. charge $7 for each round on weekdays and $10 during the weekend.

You might also like to view...

Suppose that John Maestro, the owner of a tennis shop in Evanston, Illinois, decides to purchase a new machine that restrings tennis rackets in half the time it formerly took. The new technology costs $1,000 . and the MPC is 0.80 . How much real GDP will be generated from John's $1,000 initial investment?

a. $200 b. $500 c. $1,000 d. $2,000 e. $5,000

An employer asking for a list of references from a potential employee is an example of:

A. statistical discrimination. B. screening. C. building a reputation. D. signaling.

If the variable on the vertical axis increases by 20 and the variable on the horizontal axis increases by 5, the slope of the line is:

A. 0.25. B. 4. C. 15. D. 100.

Related to the Economics in Practice on p. 626: According to a study cited in the Economics in Practice, if a country is relatively far from the technological frontier of the rest of the world, what would be its best strategy?

A. The government needs to keep helping its firms find the world frontier until the firms reach the frontier. B. The government should begin by offering incentives and encourage some risk taking. C. The government needs to help its firms find the world frontier, and then as firms approach the frontier, the government should offer incentives and encourage some risk taking. D. The government should adopt a hands-off approach and let the private sector bring the country to the world frontier.