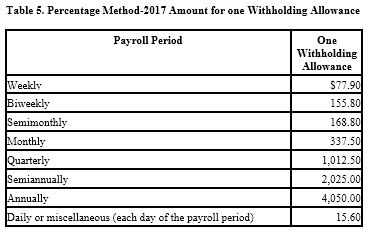

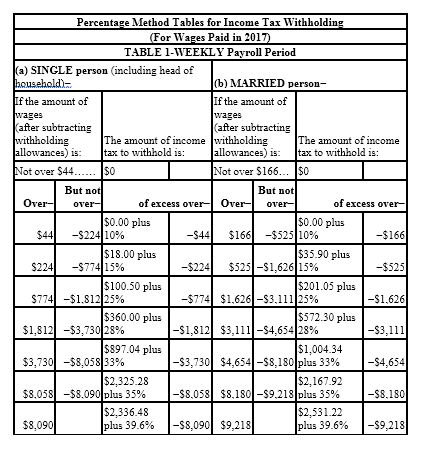

Olga earned $1,558.00 during the most recent weekly pay period. She is single with 2 withholding allowances and no pre-tax deductions. Using the percentage method, compute Olga's federal income tax for the period. (Do not round intermediate calculations. Round final answer to two decimal places.)

A) $277.93

B) $339.25

C) $257.55

D) $314.75

C) $257.55

You might also like to view...

Managers can view mashups called controls, windows that graphically summarize information about how a business is operating. _________________________

Answer the following statement true (T) or false (F)

Terry does not want her employees to be on their cell phones during work hours. She requires them to have their cell phones on mute and to remove themselves from the office for emergency phone calls. She believes that this is necessary in order to ensure the safety of the workplace, where machinery is in use and distractions may cause accidents. Describe the steps Terry should take in enforcing this policy.

What will be an ideal response?

An employee may be fired for a good reason, a bad reason, or no reason at all

Indicate whether the statement is true or false

The auditor tests the quantity of materials charged to work in process by tracing these quantities to

A. Cost ledgers. B. Perpetual inventory records. C. Receiving reports. D. Material requisitions.