Suppose there is an increase in the U.S. interest rate relative to European interest rates. How does this affect European investors?

a. Europeans decrease their demand for U.S. investments, shifting S2 to S1.

b. Europeans offer dollars for sale in order to buy euros, shifting S1 to S2.

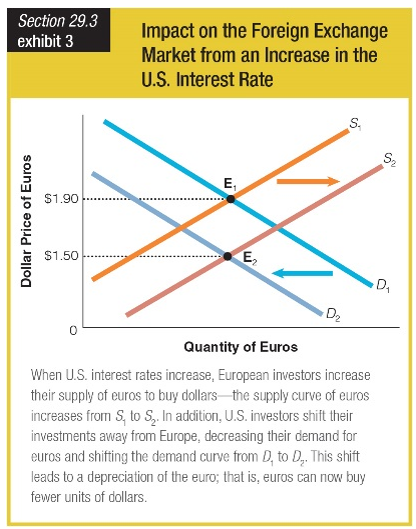

c. Europeans offer euros for sale in order to buy dollars, shifting S1 to S2.

d. Europeans increase their demand for euros, shifting S2 to S1.

c. Europeans offer euros for sale in order to buy dollars, shifting S1 to S2.

You might also like to view...

Supply-side economics

A) promotes increasing taxes to create additional revenue for government spending. B) promotes expansionary fiscal policy by increasing government spending. C) is based on the Ricardian equivalence theorem. D) promotes reducing taxes to create incentives to increase productivity.

The productivity curve shifts upward when

A) technology advances. B) physical capital increases. C) hours of labor increase. D) hours of labor decrease. E) human capital decreases.

Black markets only exist in developing nations

Indicate whether the statement is true or false

The free-rider dilemma occurs in the provision of public goods because an individual can realize the benefits of someone else's purchase (consumption) of a public good.

Answer the following statement true (T) or false (F)