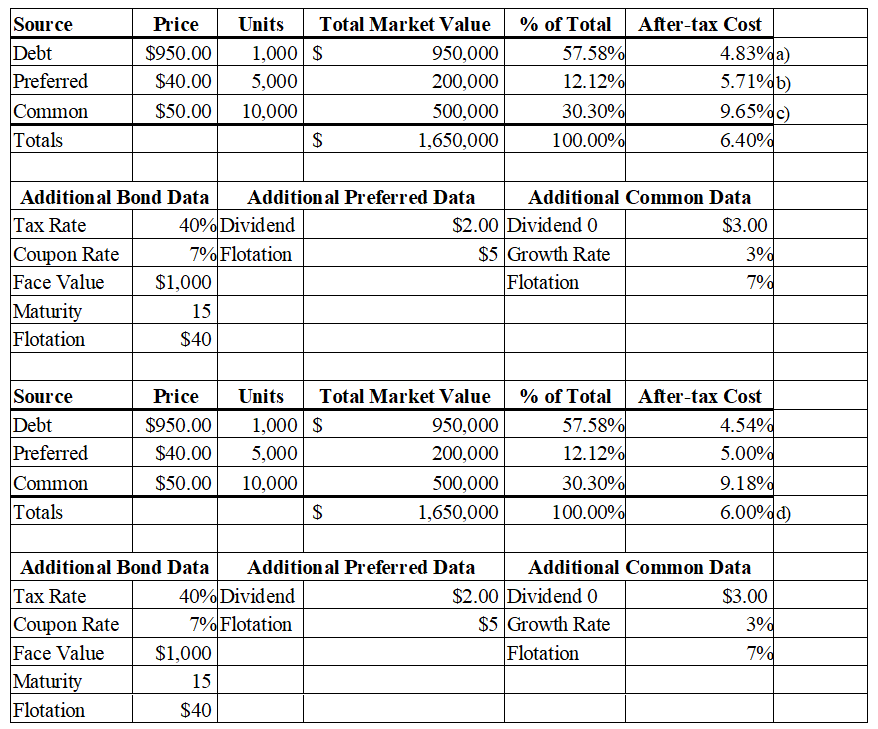

Black Diamond, Inc., a manufacturer of carbon and graphite products for the aerospace and transportation industries, is considering several funding alternatives for an investment project. To finance the project, the company can sell 1,000 15-year bonds with a $1,000 face value, 7% coupon rate. The bonds require an average discount of $50 per bond and flotation costs of $40 per bond when being sold. The company can also sell 5,000 shares of preferred stock that will pay a $2 dividend per share at a price of $40 per share. The cost of issuing and selling preferred stocks is expected to be $5 per share. To calculate the cost of common stock, the company uses the dividend discount model. The firm just paid a dividend of $3 per common share. The company expects this dividend to grow at a

constant rate of 3% per year indefinitely. The flotation costs for issuing new common shares are 7%. The company plans to sell 10,000 shares at a price of $50 per share. The company’s tax rate is 40%.

a) Calculate the company’s after-tax cost of long-term debt.

b) Calculate the Company’s cost of preferred equity.

c) Calculate the company’s cost of common equity.

d) Calculate the company’s weighted average cost of capital.

e) What is the company’s weighted average cost of capital without flotation costs?

You might also like to view...

The supply schedule of yen has a positive-sloping region, which corresponds to the inelastic region on the Japanese demand schedule for foreign currency.

a. True b. False

A reasonable person, as used in the law of torts, is a fictitious individual who is always careful, prudent, and never negligent

a. True b. False Indicate whether the statement is true or false

States have authorized the formation of limited liability companies

a. True b. False Indicate whether the statement is true or false

Refer to the data on Expected Demand for Weston Gadgets, Inc. For the various demand scenarios and their associated probabilities, the option to do nothing has an expected value of ______.

A. $37.10 million

B. $31.65 million

C. $20.10 million

D. $17.85 million