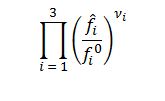

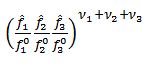

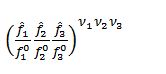

Which of the following is the correct expansion of this term?

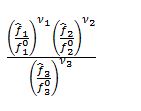

a.

b.

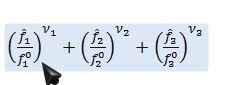

c.

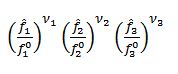

d.

e.

A. Incorrect. This you may have gotten from Example 14-4 or elsewhere in the chapter, but those examples supplied stoichiometric coefficients (the powers the fugacity ratios are being raised to). Since one of them was negative (a reactant), its term ended up in the denominator. Since no reaction is presented here, we cannot know which stoichiometric coefficients are negative.

B. Incorrect. This is the expansion of a summation (?) about the same term.

C. Correct. The entire term is repeated i times (here three). The stoichiometric coefficients can be either positive (products) or negative (reactants).

D. Incorrect. The product operator does not “reach into” the parenthesis like this.

E. Incorrect. The product does not operate within the parenthesis.

You might also like to view...

This is a popular casting material for automotive cylinder blocks, machine tools, agricultural implements, and cast iron pipe.

a. alloy cast iron b. chilled cast iron c. gray cast iron d. white cast iron

A suitable fertilizer mixture consists of _____

A) potassium, nitrogen, oxygen B) nitrogen, oxygen, phosphorous C) phosphorous, potassium, nitrogen D) phosphorous, potash, oxygen

A heat sink is a device to improve the purity of the electrons in an electrical circuit.

Answer the following statement true (T) or false (F)

Civil Engineering consulting firms that provide services to outlying communities are vulnerable to a number of factors that affect the financial condition of the communities, such as bond issues, real estate developments, etc. A small consulting firm entered into a fixed-price contract with a spec home builder, resulting in a stable income of $320,000 per year in years 1 through 4. At the end of that time, a mild recession slowed the development, so the parties signed another contract for $150,000 per year for two more years. Determine the present worth of the two contracts at an interest rate of 10% per year.

What will be an ideal response?