According to the supply-side view of fiscal policy, if the impact on tax revenues is the same, does it make any difference whether the government cuts taxes in a way that reduces marginal tax rates or in a way that does not reduce marginal tax rates?

a. No; both actions will exert the same impact on aggregate supply and demand

b. Yes; only lower marginal tax rates will increase the incentive to earn income and thereby stimulate aggregate supply.

c. No; in both cases people will increase their saving in the expectation of higher future taxes and thereby offset the stimulus effect of lower taxes.

d. Yes; interest rates will increase if marginal tax rates are lowered, whereas they will tend to decrease if marginal tax rates are left unchanged.

b

You might also like to view...

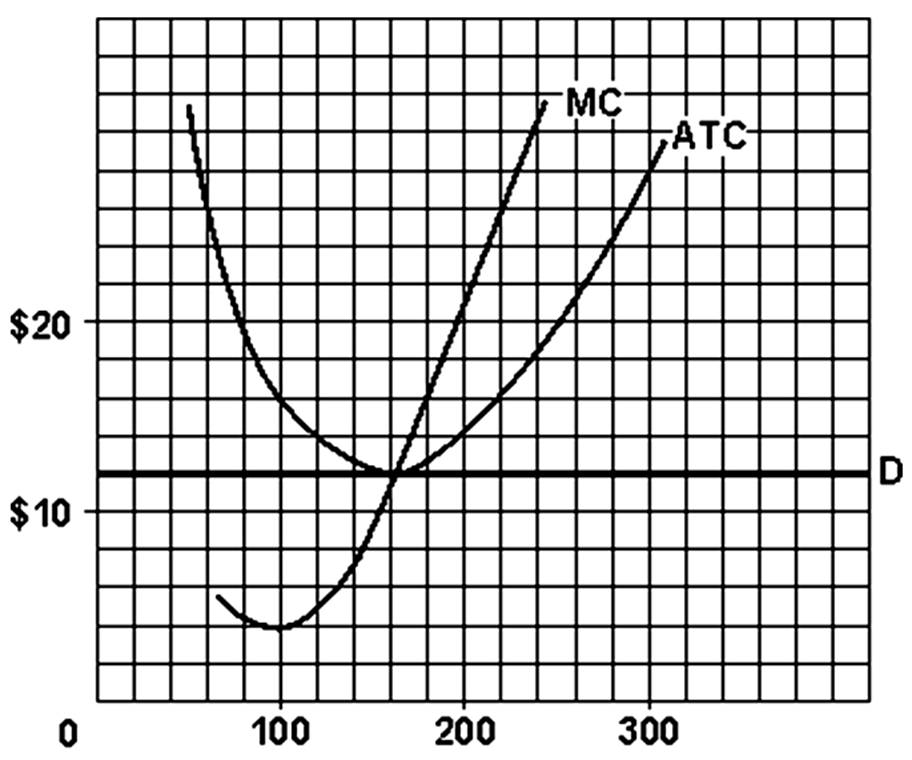

Which of the following formulas would correctly calculate a monopolist's profit?

a. profit = price – marginal cost b. profit = price – average total cost c. profit = (price – marginal cost) × quantity d. profit = (price – average total cost) × quantity

Marginal revenue at the profit-maximizing/loss-minimizing amount is

A. $4.

B. $12.

C. $14.

D. $20.

Agriculture price supports that establish a price floor at which agricultural products may be purchased that exceeds the market clearing price

A. result in the quantity of these products supplied exceeding the quantity demanded at the floor price. B. benefit taxpayers, who receive subsidies from producers that the price support program forces to sell to the government at an artificially established price. C. benefit consumers, who are willing and able to purchase more agricultural products at the floor price. D. create a shortage of agricultural products.

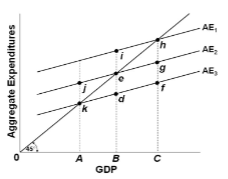

Refer to the diagram. If the full-employment level of GDP is B and aggregate expenditures are AE 1 , the:

A. inflationary expenditure gap is BC.

B. recessionary expenditure gap is BC.

C. inflationary expenditure gap is zero.

D. inflationary expenditure gap is ei.