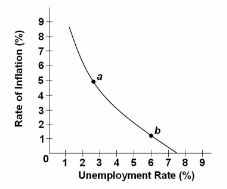

Refer to the diagram for a specific economy. Which of the following best describes a decision by policymakers that moves this economy from point b to point a?

A. Policymakers have instituted an expansionary monetary policy and/or a budgetary deficit, thereby accepting more unemployment to reduce the rate of inflation.

B. Policymakers have instituted a restrictive monetary policy and/or a budgetary surplus,

thereby accepting a higher rate of inflation to reduce unemployment.

C. Policymakers have instituted an expansionary monetary policy and/or a budgetary deficit, thereby accepting a higher rate of inflation to reduce unemployment.

D. Policymakers have instituted a restrictive monetary policy and/or a budgetary surplus,

thereby accepting more unemployment to reduce the rate of inflation.

C. Policymakers have instituted an expansionary monetary policy and/or a budgetary deficit, thereby accepting a higher rate of inflation to reduce unemployment.

You might also like to view...

When the economy is operating at a level of real GDP that is greater than its potential level, we know that

A) the structural rate of unemployment is negative. B) the frictional unemployment is zero. C) the actual unemployment rate is greater than the natural rate of unemployment. D) the cyclical rate of unemployment is negative.

When efficiency is attained, the sum of the total amount of consumer surplus and producer surplus is

A) minimized. B) maximized. C) equal to the deadweight loss. D) undefined. E) equal to zero.

The Federal Open Market Committee (FOMC) consists of: a. the Board of Governors and the Secretary of the Treasury

b. the presidents of the 12 Federal Reserve Banks. c. the Board of Governors and some of the Federal Reserve Bank presidents. d. the Comptroller of the Currency and seven Reserve Bank presidents. e. representatives from banks throughout the U.S.

Which of the following Fed actions would both decrease the money supply?

a. buy bonds and raise the reserve requirement b. buy bonds and lower the reserve requirement c. sell bonds and raise the reserve requirement d. sell bonds and lower the reserve requirement