From 1982 until 2000, stock prices rose dramatically. As measured by the NASDAQ composite, stocks went from under ________ to above ________ during this period.

A. 200; 1,400

B. 400; 5,000

C. 1,000; 11,000

D. 10,000; 200,000

Answer: B

You might also like to view...

What does the sign (positive/negative) of the income elasticity tell us about a good?

What will be an ideal response?

An economic service need not be

a. useful. b. scarce. c. transferable. d. tangible.

The rule-of-thumb for checking for weak instruments is as follows: for the case of a single endogenous regressor,

A) a first stage F must be statistically significant to indicate a strong instrument. B) a first stage F > 1.96 indicates that the instruments are weak. C) the t-statistic on each of the instruments must exceed at least 1.64. D) a first stage F < 10 indicates that the instruments are weak.

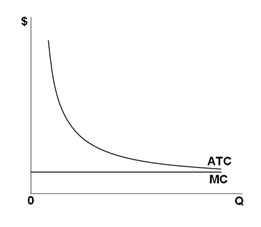

A firm that has the long-run cost curves shown in the graph below would be able to do or have the following, except:

A. Exploit economies of scale

B. Have an entry barrier protecting it from new entrants into the market

C. Serve an increasing share of the market at lower and lower unit costs

D. Attain lower unit costs by reducing its output level