Which one of the following statements is TRUE?

A) In a proportional tax system, the marginal tax rate always exceeds the average tax rate.

B) In a proportional tax system, the average tax rate always exceeds the marginal tax rate.

C) The U.S. Social Security tax is proportional.

D) The U.S. Social Security tax is regressive.

Answer: D

You might also like to view...

Both a perfectly competitive firm and a monopolist find that:

A. price is less than marginal revenue. B. it is best to expand production until the benefit and the cost of the last unit produced are equal. C. they can sell as many units of output as they want at the market price. D. price and marginal revenue are the same.

If the money supply in the economy were at MS2, and the Federal Reserve Bank used open market operations to move money supply to MS1 the overall result in the economy would be:

A. Aggregate demand shifted in, causing GDP to fall.

B. Aggregate supply shifted in, causing GDP to fall.

C. Aggregate demand shifted out, causing GDP to rise

D. LRAS move to the FE level of output.

Why might the consequences of imposing a tax on harmful fast foods not adhere to theory?

What will be an ideal response?

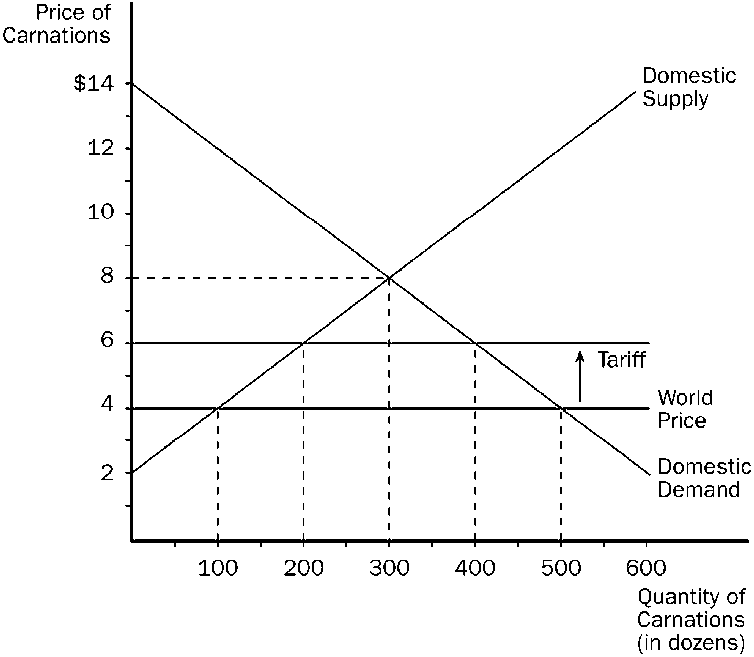

Figure 17-9

Refer to . Before the tariff is imposed, this country

a.

imports 200 carnations.

b.

imports 400 carnations.

c.

exports 200 carnations.

d.

exports 400 carnations.