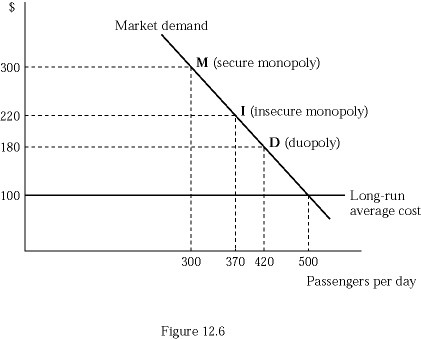

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If Fly Smart accommodates the entry, what will its profit be?

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If Fly Smart accommodates the entry, what will its profit be?

A. $44,400

B. $33,600

C. $29,600

D. $16,800

Answer: D

You might also like to view...

Does the raising of reserve requirements automatically decrease the money supply? Why or why not?

What will be an ideal response?

If the quantity of cookies purchased decreases by 30 percent as the result of a 15 percent increase in the price of oranges, the absolute value of the price elasticity of demand for cookies is

a. 0.25. b. 0.50. c. 1.25. d. 2.0.

Across the globe, exchange rate regimes are:

a. mostly fixed. b. a mix of fixed and floating. c. mostly floating. d. hard to pinpoint.

Refer to the information provided in Table 31.1 below to answer the question(s) that follow.Table 31.1PeriodQuantity of Labor (L)Quantity of Capital (K)Total Output (Y)1 50 50 2002 60 50 2203 70 50 2354 80 50 245Refer to Table 31.1. From Period 1 to Period 2, the marginal return to labor is equal to

A. 0.5. B. 1.0. C. 2.0. D. 4.0.