The productivity speed-up in the United States began in the

A. mid-1970s.

B. mid-1980s.

C. mid-1990s.

D. beginning of 2001.

Answer: C

You might also like to view...

In 2010 the federal government reduced the Social Security tax withholding rate from 12.4 percent (6.2 percent on both the employer and employee) to 8.4 percent (4.2 percent on both the employer and employee) on the wages of all workers. If the tax were redefined such that the entire 12.4 percent was statutorily levied on employers, economic analysis suggests that the actual burden of the tax

would a. remain unchanged. b. shift more heavily toward employers. c. shift more heavily toward employees. d. be different than if the entire 12.4 percent was statutorily imposed on employees.

Which of the following describes a situation in which a good or service is produced at the lowest possible? cost?

A) marginal efficiency B) productive efficiency C) allocative efficiency D) profit maximization

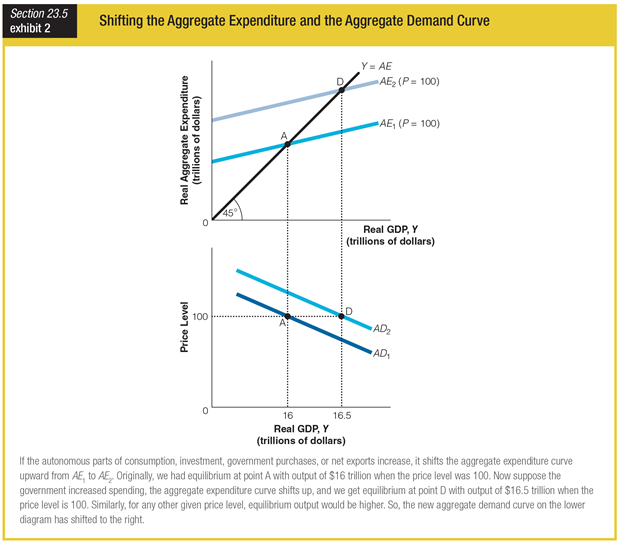

Assume the economy is at point D. If RGDP demanded increased to $17 trillion, how would AE2 shift?

a. It would shift above AE2.

b. It would shift below AE2 but remain above AE1.

c. It would shift below AE1.

d. It would not change.

It is efficient not to alter the amount of pollution produced by the market.

Answer the following statement true (T) or false (F)