Which of the following is NOT one of the reports or financial statements the bookkeeper issues at the end of every accounting period?

A) balance sheet

B) income statement

C) statement of cash flows

D) income tax return

E) profit-and-loss statement

Answer: D

Explanation: D) Once the bookkeeper has the correct figures, he or she can use that summarized data to issue three reports, or financial statements: the balance sheet, the income statement (also known as the profit and loss statement), and the statement of cash flows. The income tax return is NOT one of these regular reports.

You might also like to view...

The objectives of just-in-time (JIT) manufacturing usually include all of the following except:

a. large lot sizes b. zero defects c. zero setup times d. zero lead times

Relationship behaviors ______.

A. facilitate goal accomplishment B. focus on personal advantage for the leader C. help group members feel comfortable with one another D. provide structure

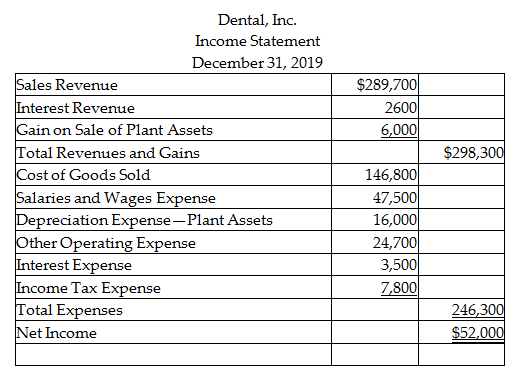

Use the direct method to compute the payments made to employees. (Accrued Liabilities relate to other operating expense.)

Dental, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2019:

A) $72,200

B) $43,500

C) $24,700

D) $47,500

The ________ of a business firm is measured by its ability to satisfy its short-term obligations as they come due

A) activity B) liquidity C) debt D) profitability