After paying down the mortgage on their personal residence, the Hills have found that their itemized deductions for each year are always slightly less than the standard deduction option

a. Explain what has happened.

b. What remedy do you suggest?

a. Paying down the mortgage reduced the interest expense deduction. With less interest expense, the Hills' deductions from AGI no longer exceed the standard deduction amount.

b.

The Hills should begin concentrating their other itemized deductions (e.g., charitable contributions) by paying for multiple years in the same year. Being on a cash basis, the timing of the deduction is based on the year of payment. In alternate years, moreover, the standard deduction is claimed.

You might also like to view...

Which statement below is true about Web 4.0?

A) it failed to offer a multichannel communication system that would allow businesses and customers to speak to each other B) it included interactive company and brand websites, social media, blogs, and other communication formats C) it created online communities that connected buyers and sellers in new ways D) it allowed customers to visit bricks and mortar stores over the Internet in real time

Representatives of the apparel, footwear, furniture, and textile industries in many countries are deeply concerned about the impact that increased trade with ________ will have on these sectors

A) Hong Kong B) China C) Italy D) India E) Bangladesh

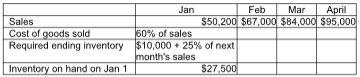

Calculate cost of goods sold for the month of February.

Mimosa, Inc., a merchandising company, has the following budgeted figures:

A) $16,750

B) $30,120

C) $29,370

D) $40,200

The survey-based process known as ________ is designed to explore advertising effectiveness

A) brand awareness B) brand health C) return on investment D) key performance indication E) copy testing