Supply-side economists argue that

A) lower tax rates always lead to lower tax revenues.

B) higher tax rates lead to increased productivity.

C) lower tax rates sometimes lead to increased tax revenues.

D) lower tax rates lead to a drop in real Gross Domestic Product (GDP).

C

You might also like to view...

Money is always neutral. This statement is most likely to be made by a proponent of the

a. new Keynesian model. b. monetarist model. c. real business cycle model. d. classical model. e. both c and d.

Which of the following is not an example of the opportunity cost of going to school?

a. The money a student could have earned by working if he had not gone to college. b. The nap a student could have enjoyed if he had not attended class. c. The party a student could have enjoyed if he had not stayed in to study for his exam. d. The money a student spends on rent for his apartment while attending school.

If the debt of the federal government decreases by $20 billion in one year the budget:

A. deficit in that year must be $20 billion. B. surplus in that year increases by $20 billion. C. deficit in that year decreases by $20 billion. D. surplus in that year must be $20 billion.

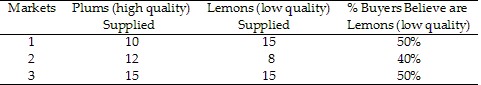

Refer to Table 9.1. In which market do buyers underestimate the chance of getting a lemon?

Refer to Table 9.1. In which market do buyers underestimate the chance of getting a lemon?

A. 1 only B. 2 only C. 3 only D. 1 and 3 only