Provide an appropriate response.IRS guidelines state that a married person under 65 years of age who can be claimed as a dependent on another person's tax return must file a return if(i) unearned income was over $750; or(ii) earned income was over $3925; or(iii) total of earned and unearned income was at least $5 and your spouse files a separate return and itemizes deductions; or(iv) total of earned and unearned income was more than the greater ofa) $750; orb) earned income (up to $3675) plus $250.Kevin is 25 years old and can be claimed as a dependent by his mother. He had earned income of $3500 and unearned income of $700. Kevin's wife Linda files a separate return but does not itemize deductions. Must Kevin file a return? Explain.

What will be an ideal response?

Yes, Kevin must file a return. He is a married person under 65 years of age who can be claimed as a dependent on another person's tax return. As such, he must file a return if any of (i)-(iv) apply.

(i) does not apply since $700 < $750;

(ii) does not apply because $3500 < $3925;

(iii) does not apply because although his spouse (Linda) files a separate return, she does not itemize;

(iv) does apply. The total of earned and unearned income ($3500 + $700 = $4200) is greater than both (a) $750 and (b) earned income (up to $3675) plus $250 ($3500 + $250 = $3750). Thus, Kevin must file a return. (Explanations will vary.)

You might also like to view...

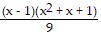

Find the sum of the geometric series for those x for which the series converges.

A.

B.

C.

D.

Find the determinant of the given matrix.

A. -46 B. -306 C. -186 D. 306

Find the slope of the line through the pair of points.(-5.8, -3.4) and (7.7, 4.1) Round to the nearest tenth.

A. 7.5 B. -0.6 C. 13.5 D. 0.6

Use the quotient rule to find the derivative.y =

A. y' =

B. y' =

C. y' =

D. y' =