In 2008, Stark Finance Group suffered a huge loss in business. The best strategy to minimize the loss was to fire many employees. However, the CEO was against the idea and suggested reducing costs by decreasing the salary of each employee instead. He

believed this would benefit the employees, but it was observed that productive workers resigned because of the decrease in salary. Why do you think the CEO's idea did not work out? What would have been a more efficient course of action?

The CEO of Stark Finance Group adopted the adverse selection of wage cuts argument. This argument points out that if an employer reacts to poor business conditions by reducing wages for all workers, then the best workers—with the best employment alternatives at other firms—are more likely to leave, while the least attractive workers, with fewer employment alternatives, are more likely to stay.

The best course of action for Stark Finance Group would be to choose which workers should depart, through layoffs and firings, rather than trimming wages across the board.

You might also like to view...

Which of the following is NOT an asset of a bank?

A) Cash equivalents of the bank B) Stockholders' equity C) Long-term investments made by the bank D) Official bank reserves

In their pure forms, laissez-faire economies and command economies do not exist in the world.

Answer the following statement true (T) or false (F)

When there are fewer substitutes for a product, the ________ for the product is ________.

A. demand; more price elastic B. income elasticity; greater C. income elasticity; smaller D. demand; less price elastic

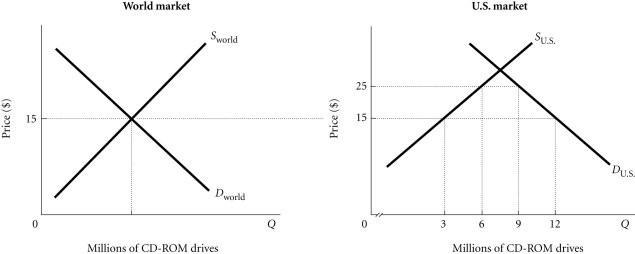

Refer to the information provided in Figure 4.5 below to answer the question(s) that follow. Figure 4.5Refer to Figure 4.5. If a $10.00 per CD-Rom drive tariff is levied on imported CD-Rom drives, the United States will

Figure 4.5Refer to Figure 4.5. If a $10.00 per CD-Rom drive tariff is levied on imported CD-Rom drives, the United States will

A. import 3 million CD-Rom drives. B. import 6 million CD-Rom drives. C. import 9 million CD-Rom drives. D. import 12 million CD-Rom drives.