Which one of the following would be added to net income in determining net cash flows from operating activities by the indirect method?

a. increase in accounts receivable

b. depreciation expense

c. increase in inventories

d. decrease in income taxes payable

b

You might also like to view...

Determine the February 20xx residual income for an investment center with the following information: Operating income for the month ended February 28, 20xx $2,900,000 Desired ROI 52% Actual ROI 38% Assets invested $18,200,000

a. ($4,016,000) b. ($5,836,000) c. ($6,564,000) d. ($8,384,000)

What are some key questions to be considered when conducting a comparative HRM study?

What will be an ideal response?

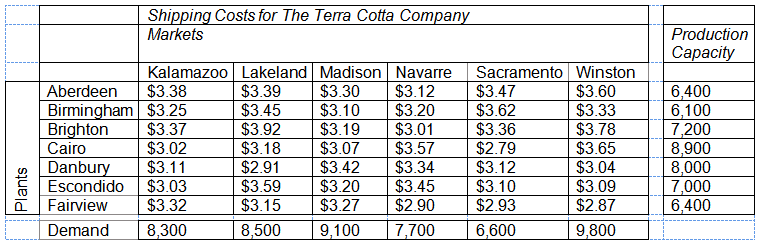

Refer to the shipping costs for The Terra Cotta Company. Solve the transportation problem using Excel Solver. (Remember that in balanced transportation problems all constraints—except the non-negativity constraints of the decision variables—should be set as an equal-to (=) sign in the Excel Solver dialogue.) At the optimum solution, which of the following statements is true?

a. The shipping costs from Brighton to Navarre are $21,672.

b. The shipping costs from Cairo to Navarre are $5,580.

c. The shipping costs from Cairo to Sacramento are $9,570.

d. The shipping costs from Fairview to Madison are $18,414.

KAB Inc., a small retail store, had the following results for May. The budgets for June and July are also given. May(actual) June(budget) July(budget)Sales$42,000 $40,000 $45,000Less cost of goods sold 21,000 20,000 22,500Gross margin 21,000 20,000 22,500Less selling and administrative expenses 20,000 20,000 20,000Net operating income$1,000 $0 $2,500?Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.?The cash disbursements during June for goods purchased for sale and for selling

and administrative expenses should be: A. $40,000 B. $41,000 C. $43,500 D. $42,500