What is the relationship between the real interest rate, the supply of loanable funds and the demand for loanable funds?

What will be an ideal response?

The supply of loanable funds has a positive relationship between the real interest rate and the quantity of loanable funds supplied. In a figure, a supply of loanable funds curve has a positive slope. Similarly, the demand for loanable funds is the relationship between the real interest rate and the amount of loanable funds demanded. In a figure, a demand for loanable funds curve has a negative slope.

You might also like to view...

"Under floating rates, the economy is more vulnerable to shocks coming from the domestic money market." Discuss

What will be an ideal response?

Everything else held constant, a decrease in government spending will cause the IS curve to shift to the ________ and aggregate demand will ________

A) right; increase B) right; decrease C) left; increase D) left; decrease

Advance-purchase discounts offered by airlines are an example of

a. Direct price discrimination b. Indirect price discrimination c. All of the above d. None of the above

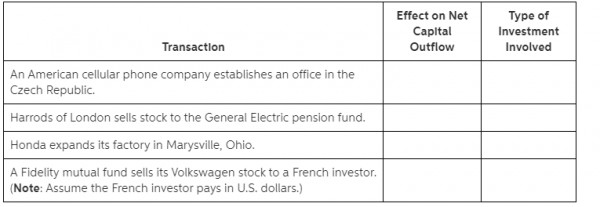

Complete the following table by indicating the effect each of the following transactions has on U.S. net capital outflow and whether it involves direct investment or portfolio investment.

HINT: Effect on Net Capital Outflow answer choices are Decreased or Increased. The Type of Investment Involved answer choices are Direct Investment or Portfolio Investment.