Which of the following is correct concerning stock market irrationality?

a. Bubbles could arise, in part, because the price that people pay for stock depends on what they think someone else will pay for it in the future.

b. Economists almost all agree that the evidence for stock market irrationality is convincing and the departures from rational pricing are important.

c. Some evidence for the existence of market irrationality is that informed and presumably rational managers of mutual funds generally beat the market.

d. All of the above are correct.

a

You might also like to view...

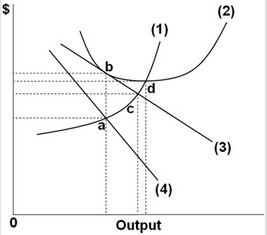

Use the following graph for a monopolistically competitive firm to answer the next question. Point b indicates

Point b indicates

A. the price-output combination that yields maximum profits. B. the lowest possible cost of the firm's product. C. a situation where the firm is earning economic profits. D. a point that cannot be the long-run equilibrium point.

If marginal cost of an additional unit of output is greater than average cost, then average cost will rise.

Answer the following statement true (T) or false (F)

The type of currency in circulation in the modern U.S. economy is almost entirely

A. commodity money. B. metallic money. C. fiat money. D. silver certificates.

A government can maximize efficiency in monopoly markets by setting prices equal to the monopolist's average cost of production albeit at the cost of reduced long term innovation.

a. true b. false