Thyne Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.InputsStandard Quantity or Hours per Unit of OutputStandard Price or RateDirect materials 6.9grams$9.20per gramDirect labor 0.90hours$21.20per hourVariable manufacturing overhead 0.90hours$3.60per hourThe actual output for the period was 3,900 units.The standard amount of materials allowed for the actual output is closest to:

A. 26,910 grams

B. 26,900 grams

C. 28,980 grams

D. 24,979 grams

Answer: A

You might also like to view...

Management has been found involved in many fraudulent schemes; a common one is "channel stuffing.". What does "channel stuffing" involve?

a. Overly complex transactions. b. Growth through stock acquisitions. c. Shipment of goods not ordered. d. Management compensation schemes.

Hosanna Furnishings finished Job A40, which involved $4,000 of direct materials and $600 of direct labor. Hosanna uses a predetermined overhead allocation rate based on 40% of direct labor costs

Provide the journal entry needed to record the completion of the job. Omit explanation.

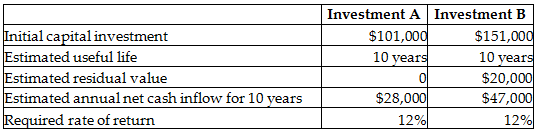

Calculate the payback period for Investment A. (Round your answer to two decimal places.)

Dragonfly, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

A) 2.22 years

B) 2.89 years

C) 1.00 year

D) 3.61 years

Taxation is a financial force in that

A. it is not controlled by the firm. B. businesses are compelled by foreign governments to pay taxes. C. if the firm can achieve a lower tax burden than its competitors, it can generate higher revenues, and then lower its prices or pay higher wages and dividends. D. governments that enact taxes are formal institutions that enforce tax law via force.