If the annual real interest rate on a 10-year inflation-protected bond equals 1.5 percent and the annual nominal rate of return on a 10-year bond without inflation protection is 4.2 percent, what average rate of inflation over the ten years would make holders of inflation-protected bonds and holders of bonds without inflation protection equally well off?

A. 4.2 percent

B. 2.7 percent

C. 1.5 percent

D. 5.7 percent

Answer: B

You might also like to view...

The Sandy Deli operates near a college campus. It has been selling 325 sandwiches a day at $1.75 each and is considering a price cut. It estimates 450 sandwiches would sell per day at $1.50 each. Calculate the marginal revenue of such a price cut and the elasticity between the two points

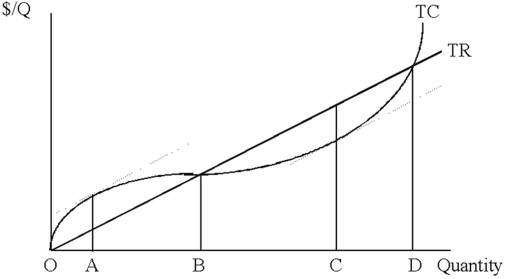

In the long run,

A. the total revenue curve will change its slope. B. the firm will operate at point C. C. the firm will operate at point B. D. the firm will operate at point D.

Which of the following is a nominal quantity?

A. The number of people unemployed B. The amount of coal mined in one month C. The current price of a barrel of oil D. The number of cars produced in 2017

In 2008, interest rates on Treasury securities fell even though most other interest rates were rising.

Answer the following statement true (T) or false (F)